16 Mar 21

Rightsholders take note. In time, it may not be enough to protect your rights in the physical and digital space - you may have to enter the metaverse too

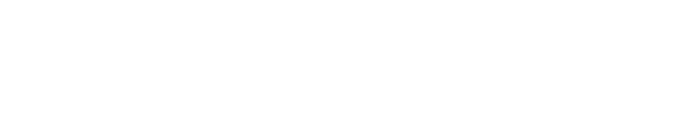

As my fellow Liverpool supporters will tell you, it’s been a rough start to 2021. So to cheer myself up this week, I decided to buy Anfield. Well, to be precise, I bought about one quarter of it, specifically the Main Stand. I didn’t have to negotiate with Liverpool FC and I paid just over £100. You’ll be unsurprised to hear that I don’t suddenly hold the title deeds to Anfield. Instead, I acquired a “non-fungible token” or NFT, a few lines of code that evidence my ownership of a unique plot of digital land which has been mapped onto the real world by a new blockchain platform called SuperWorld. In this article I’ll explain why I did it, and what real estate NFTs might mean to the sports industry.

Anfield Stadium on SuperWorld. Copyright: Mapbox, Open Street Map, Maxar, SuperWorld, 2021

What are NFTs?

In simple terms, an NFT evidences ownership of a one-of-a-kind digital asset[1]. NFTs are underpinned by blockchain technology and can be freely traded, with each transaction creating an immutable public record of ownership which is almost impossible to tamper with. NFTs can be linked to any kind of digital asset (for example, a video, audio file or piece of digital real estate) and are “non-fungible” because each token is entirely unique. By contrast, “fungible” assets such as currency (dollars, bitcoins etc) can be exchanged for other identical tokens of the same value.

NFTs are currently exploding, most notably in relation to artwork and other digital collectibles. In the context of sport, much has been written about the NBA’s collaboration with Top Shots, which allows fans to collect and trade NFTs in the form of unique or limited edition NBA highlights. On 11 March, Christie’s auction house in London sold an NFT artwork by digital artist Beeple for a staggering $70m, instantly making Beeple the third most valuable living artist after David Hockney and Jeff Koons. If you’re still confused, this succinct article by Zachary Crockett explains more about the booming NFT market.

Copyright: Beeple: EVERYDAYS: THE FIRST 500 DAYS. Handout from Christie’s, 2021

Real Estate NFTs

Investment in real estate NFTs is growing fast too, providing digital spaces and worlds for individuals to create, explore and exploit. As in real life, real estate NFTs usually come with certain rights, such as the ability to build on your land, display advertising on it or rent it out to others. In the past few years, the most popular real estate NFTs have appeared within fictional online worlds, each of which has its own unique character and features. Axie Infinity allows players to roam a digital universe populated by Pokemon-esque creatures called “Axies“, with a prime piece of land selling for $1.5m in February. Decentraland is less gaming-focused than Axie Infinity and allows users to explore fictional cities casually and interact with each other for business or entertainment.

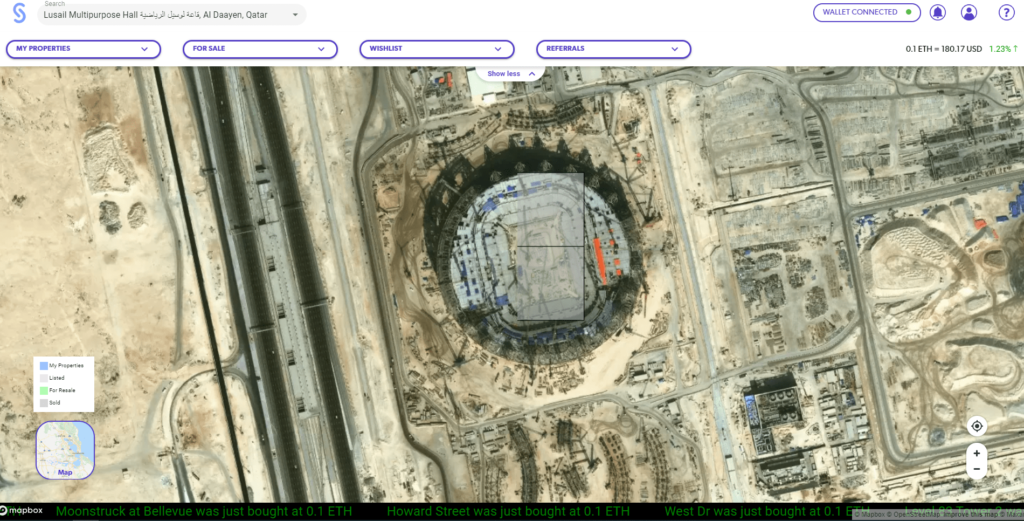

In addition to these fictional worlds, new “metaverses” are emerging which are more anchored to the real world. The SuperWorld platform has divided earth into 64bn unique parcels of digital land of 100m by 100m, each of which can be purchased from the platform for a fee and then freely traded between users. SuperWorld is at an early-stage, but its team promises that virtual landowners will be able to “share revenue generated on their property; through advertising, e-commerce, data, analytics, transactions, gaming and much more“. It is as yet unclear how SuperWorld intends to achieve this, but there has been a recent surge of interest in the platform, with users clearly targeting cultural venues such as art galleries and sports stadia. In the UK, real estate NFTs relating to Stamford Bridge, Old Trafford, Lord’s Cricket Ground, Wimbledon, the London Stadium and the Tottenham Hotspur Stadium have all recently been acquired (although interestingly, Twickenham is still available at the time of this article). The same trend is apparent on a global basis on SuperWorld. For example, users have already purchased NFTs relating to Lusail Stadium in Qatar, which will host the FIFA World Cup Final next year.

Lusail Stadium in Qatar on SuperWorld, the venue for the 2022 FIFA World Cup Final. Copyright: Mapbox, Open Street Map, Maxar, SuperWorld, 2021

If SuperWorld follows through with its stated plans, I will be free to commercially exploit my NFT in Anfield using whatever digital tools SuperWorld makes available to its users. I could turn Anfield into a community venue for fans to congregate virtually and discuss the team, or operate and sell unofficial tours to fans who would otherwise never have the opportunity visit Anfield. I could even sell advertising to brands which compete with official club sponsors in a digital space free from physical constraints. For example, I could build out the Main Stand digitally and sell advertising on it, or put a giant neon ad on the Kop (distressing thought though it is). This is not to mention some of the more mischievous potential uses of digital stadia – it doesn’t take much effort to imagine the fun a Manchester United supporter could have with the keys to digital Anfield.

Of course, all of this remains hypothetical for now and SuperWorld would need to invest in a lot more development to support such features, but as interest in real estate NFTs grows, VR/AR technology improves and “real-world” metaverses become more sophisticated, sports properties should prepare now to protect their brand (and their real estate) in these emerging digital worlds.

Legal and Practical Steps

In theory, sports properties can continue to rely on the usual legal tools under English law to take action against third parties (including virtual landowners) who infringe their intellectual property rights or who seek to commercially exploit an unauthorised association with their brand. Sports properties may own copyright in the architecture itself, but this often belongs to the architect and in the case of many older stadia in the UK, such copyright protection may have expired. There may be branding visible on the stadium (for example, club crests) which is trade marked, and it is possible that the stadium itself may benefit from trade mark protection in the form of a 3D shape mark, although 3D marks are generally difficult to register and enforce. In addition to the above, it may be possible for rightsholders to bring a “passing off” claim against the virtual landowner (or any virtual tenant or advertiser) on the basis that their use of the digital real estate is likely to misrepresent to the public that it has a formal association with the sports brand in question.

Regardless of the legal protections relied upon, the anonymous and global nature of blockchain-based NFT ownership presents additional barriers to traditional methods of rights protection. It is typically very difficult to identify virtual landowners, and even if you did, they could be based anywhere in the world. Once the real estate NFTs have been purchased, rightsholders may already be playing catch-up.

As a result, alongside the legal remedies outlined above, what practical steps can sports properties take to protect their rights in relation to platforms such as SuperWorld? In the context of real estate NFTs, we recommend a proactive rights protection strategy to ensure that rightsholders remain on the front foot:

- Monitoring: ensure that staff and/or contracted rights protection agencies have expertise in the blockchain and NFT market and implement a robust process for identifying and reporting on new NFT platforms at an early stage (particularly those metaverses which are based upon or mapped onto the real world).

- Dialogue: initiate a dialogue with real estate NFT platforms deemed to be a potential risk as soon as possible to ascertain their plans and, where appropriate, remind them of their legal obligations.

- Acquisition: consider the strategic acquisition of selected real estate NFTs (e.g. NFTs linked to your venue). For a relatively small investment, a savvy acquisition strategy may save a huge amount of time and cost later down the line (and could even present commercial opportunities in the future).

It is too early to tell whether real estate NFTs will create the next rights protection battleground for the sports industry, but it is likely that metaverses will continue to develop in complexity and sophistication. As the anonymous purchaser of Axie Infinity’s most expensive plot put it: “We’re witnessing a historic moment; the rise of digital nations with their own system of clearly delineated, irrevocable property rights“. Rightsholders take note – in time, it may not be enough to protect your rights in the physical and digital space, you may have to enter the metaverse too.

[1] Zachary Crockett, “Why NFTs are suddenly selling for millions of dollars” (https://thehustle.co/why-nfts-are-suddenly-selling-for-millions-of-dollars).